I previously interviewed attorney Bruce Matzkin in September 2024.

At the time, we talked about his representation of Robert Dunn in a dispute with his business partner, Joseph Voll.

In the previous interview, we focused on the blatant conflict of interest Judge Kari Dooley, along with the Connecticut bar, ignored in the case.

At different times, attorneys Michael Conway and Liz Acee represented Joseph Voll on behalf of MacDaddy, the restaurant he co-owned with Dunn. They also represented Voll’s daughter, on behalf of Mac N’Out, a competitor that Voll secretly started.

I reached out to Voll, Conway, and Acee, but none responded to my emails for comment.

Judge Dooley saw the inherent conflict of interest.

“It just seems to me at some point you might be cross-examining Katelyn Voll,” Judge Dooley said to the attorneys in one hearing.

Though she seemed to recognize the inherent conflict of interest, she did not rule that there was a conflict and allowed them to represent all parties at once.

The conflict that was ignored was bad enough, but Judge Dooley’s order was shocking.

Before we get to that, here is a summary of the case.

In 2011. Robert Dunn opened up MacDaddy’s, a mac n cheese fast food joint in Connecticut.

About a year later, he partnered with Joseph Voll. Voll was to get 50% of the business, and in exchange, he provided the capital to open two new locations.

From the beginning, Dunn took money out of the register to pay himself.

Every time, Dunn provided a receipt to the bookkeeper who made a notation.

Once Voll discovered that Dunn was taking money out, he sued. Voll claimed that Dunn was stealing; he filed a suit on behalf of MacDaddy even though he had not fulfilled his end of the deal yet.

There was nearly a settlement, Bruce told me, except Dunn discovered that Voll was contacting vendors on behalf of a new franchise, Mac N’Out. This would violate a non-compete clause, and this led to a flurry of new lawsuits.

As this was going on, Voll discovered an old judgment, unrelated, in which Dunn owed approximately $100,000. He bought the judgment and then claimed that this judgment entitled him to Dunn’s 50% of their company.

If successful, Voll would take over MacDaddy without providing anything.

Judge Dooley was not the original judge on the case, but she had the most profound effect on the case.

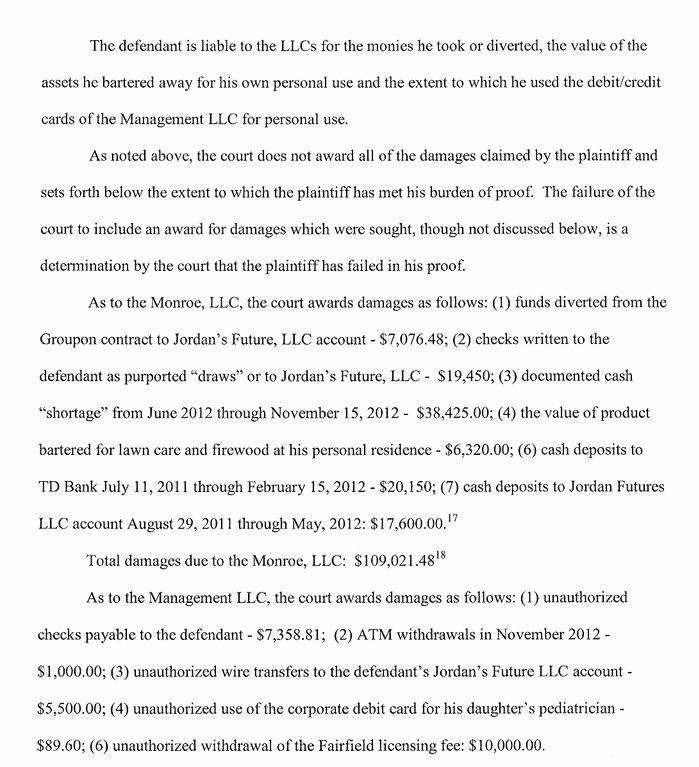

In her order from November 10, 2014, Judge Dooley dropped the hammer on Robert Dunn. She called him the “least credible,” litigant she had presided over.

Judge Dooley further stated, “The defendant’s conduct amounts to self-dealing of the most egregious type. He treated the fiscal assets of the Management LLC, the Monroe LLC, and to a lesser extent the Fairfield LLC as his own personal ATM.”

Dunn spoke to me in preparation for this story. He categorically disagreed with this characterization. He said he worked day and night at MacDaddy. It was his business that he developed.

He was entitled, he told me, to pay himself. Furthermore, everything was above board as every penny was accounted for.

In fact, Judge Dooley knew exactly how much was taken because Dunn accounted for it.

Bruce told me this was a simple case made complicated. He believes there was collusion of some sort. Bruce said that what needed to happen was for a judge to rule that his client had to pay some or all of the withdrawals back.

Instead, a massive litigation occurred. Judge Dooley not only ruled that Dunn committed theft, but unfair trade practices.

Judge Dooley not only ordered him to pay the money back but tripled it and ordered Dunn to pay attorney’s fees.

Dunn was devastated by the ruling, but the devastation was just beginning. By the time Judge Dooley ruled, Voll had already maneuvered and sold to himself Dunn’s share of MacDaddy’s.

Dunn filed for bankruptcy to stop the sale. That bankruptcy was withdrawn on December 2, 2013, and on December 3, 2013, Voll had an auction scheduled. Voll then determined how much Dunn’s interests in MacDaddy were worthy. He bought them for less than what Dunn owed, and suddenly, someone who put nothing in, owned all of MacDaddy’s.

Judge Dooley had a chance to right this wrong. Bruce told me the law was on his side, namely the LLC act. This act lays out how a creditor is to get paid from an LLC, like MacDaddy’s. The act seems to bar what Voll did. The LLC Act allows a judgment creditor to receive payment from an LLC. It does not allow the judgment holder to simply take an ownership interest away.

Judge Dooley knew the LLC Act was in place, and so she did mental gymnastics to try and get around it.

Judge Dooley argued that the LLC Act allows can cede to an operating agreement,

“Except as provided in writing in an operating agreement.” Judge Dooley wrote in her order.

This business had an operating agreement which did not explicitly forbid such an action.

As such, this was kosher. Voll got Dunn’s 50% without spending a dime. Dunn lost the business he built. Bruce said this is very problematic because Voll was allowed to quantify how much Dunn’s share was worth and then claim it was less than what Dunn owed.

If this became the standard, everyone would look to buy debt and use that to take over a business.

To make matters worse, Dunn was then smeared in the press, in the form of a Forbes article from 2015.

The article had two big problems: first it erroneously stated that Dunn and Voll were partners from the beginning, making it look like Dunn was stealing from day one, as opposed to merely continuing to pay himself.

Second, the article was based entirely on Dooley’s order.

Joseph Voll and Robert Dunn were business partners in a pair of restaurants in Connecticut called Macdaddy's Macaroni & Cheese Bar. One restaurant was held in what would be known shorthand as the Monroe LLC, and the other similarly as the Fairfield LLC. A third company without a restaurant, the Management LLC, provided operational services to both Monroe LLC and Fairfield LLC.

Voll and Dunn owned all three LLCs as 50%-50% members, with the idea that profits would flow up from Monroe LLC and Fairfield LLC into the Management LLC, which would then distribute the profits equally to Voll and Dunn.

Voll was a construction general contractor, and he contributed the moneys and labor to build the first restaurant, which would go into Monroe LLC. For his 50%, Dunn contributed the concept, menus, and operational support. Dunn then was working as an investment broker, but soon agreed to give up that job and work at Monroe LLC on a full-time basis.

The first Macdaddy's opened on July 4, 2011, but even before the concept was proven to be viable on a long-term basis, Voll and Dunn started looking for a second location only a few months later. The two decided on a location, and cut a deal with the property owner whereby Voll, Dunn, the property owner and his wife (the latter two, the Swansons, taking profits in lieu of rent), would all be 25% owners in the second company, being the Fairfield LLC. Certain licensing fees and royalties would also be paid to Management LLC, which was owned only by Voll and Dunn.

Even with that, the author knew that Dooley’s order stunk.

This is one of those cases where the Court reaches the correct result, Voll wins on the charging order issue, based on a bunch of shoddy, and sometimes flatly incorrect, reasoning. Fortunately, the Court had the good sense to designate that this Opinion would not be published so that no subsequent tribunal would be handcuffed into following its often faulty logic.

“Voll wins on the charging order issue, based on a bunch of shoddy, and sometimes flatly incorrect, reasoning.” the article’s author Jay Adkisson stated.

I reached out to Mr. Adkisson by email, but he did not respond.

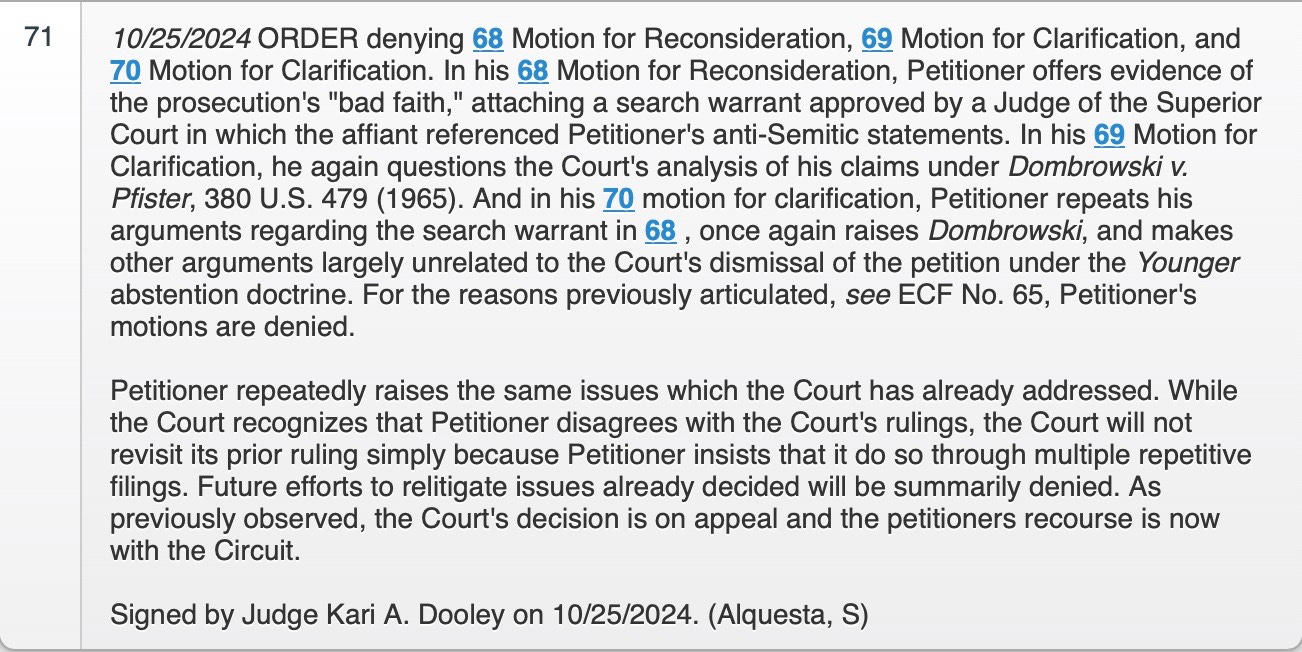

Judge Dooley would go onto to be appointed to a federal bench in 2018; she is currently overseeing Paul Boyne’s case, when he tries to have his case thrown out federally. Recently, she had a bit of temper tantrum.

Judge Dooley appears to suggest that a search warrant based strictly on alleged anti-Semitism is also kosher, pardon the pun. Judge Dooley’s respect for the first amendment in Boyne’s case is as healthy as her respect for property rights in the MacDaddy’s case.

Share this post