Justin Beck is the latest guest on the podcast, and it’s on video again.

{If you missed the last one with Jeana Kuczmanski, check it out here}

Justin was a successful California business executive until he crossed paths with a

scumbag lawyer from Orange County named Ken Catanzarite.

In the podcast, I referred to an opinion from a California Appeals Court which largely mirrored what Justin mentioned: find the opinion here.

Justin joined Cultivation Technologies, Inc., (CTI) a California marijuana cultivation company- where marijuana is legal- in 2015.

At the time, another company, Mobil Farming Systems (MFS), had recently failed.

Many of the principles of MFS started CTI along with Beck. The investors in MFS were given an opportunity to invest in CTI.

Most did: one who did not was Roger Root.

Enter Ken Catanzarite. He filed a lawsuit initially on behalf of Roger Root, claiming he was the victim of elder abuse on the part of some of the principles of CTI, not Justin.

The Appeals Court explained it.

Beck's complaint alleged all was going well until Catanzarite filed a complaint in September 2018 for Denise Pinkerton. Pinkerton claimed to be acting as attorney in fact for Root, individually and as successor in interest to the claims of his deceased spouse (Sharon Root). The complaint alleged the Roots owned MFS common stock and that the lawsuit was also a shareholder derivative action on behalf of MFS.

The complaint alleged multiple causes of action against CTI, the original board members (O'Connor, Cooper, and Probst), Joseph R. Porche (MFS's securities salesperson), and all parties having a connection to CTI. This included Beck, as CTI's chief strategy officer and his two companies (RAD and EM2), which held CTI Founder's stock. Similarly, the complaint named TGAP, Higgerson, Aroha, Scudder, and Unfug as defendants holding shares of CTI Founder's stock. The complaint included, Mobin, who held 250,000 shares of CTI stock, shared an office with Porche, and acted as vice president of shareholders relations of MFS and CTI. The complaint explained Bernheimer was included in the lawsuit because he was an attorney who worked with CTI's management team "since inception" and served as chief counsel since 2017. Another defendant, Einhorn, was an attorney and director of CTI. Finally, Motta was included due to his current role as CTI's CEO and a director.

The Roots alleged that in 2012 and 2013, MFS identified itself as an agricultural technology company that manufactured residential hydroponic growing systems. The Roots understood growing marijuana was the anticipated use of MFS's products. In 2014, they heard MFS's directors and Mobin discuss the business opportunities created by the anticipated legalization of marijuana. Root asserted the MFS shareholders were told about the formation of CTI and that it would become MFS's subsidiary. The complaint cited to CTI's Organizational Consent stating MFS would hold 28,000,000 CTI shares of common stock. The Roots claimed they received letters signed by Probst, O'Connor, Cooper, and Mobin about CTI's progress. The complaint also referred to CTI's Amended Acts, which stated the CTI "shares had not been transferred or provided" to MFS. The Roots quoted from the Amended Acts, explaining MFS's board members rescinded MFS's promised shares and instead issued 23,000,000 shares to the Founders. Specifically, the complaint noted O'Connor, Probst, Cooper, and TGAP spent a total of $15,500 to acquire 15,500,000 out of the 23,000,000 shares, giving them 67.3913 percent control of CTI. This percentage was "materially greater than their control ownership of MFS."

I reached out to Scudder, O’Connor, Probst, Cooper, Higgerson, along with Catanzarite, but I received no response.

The appeal continued.

Several causes of actions were based on the factual allegation Probst, O'Connor, Cooper, Mobin, and Porche received illegal commissions on the sale of MFS securities to the Roots. These defendants were not licensed broker-dealers in California or Florida when they sold the shares. These specific five defendants told the Roots the MFS shares were being sold pursuant to a PPM, and therefore, "purportedly exempt from registration under the federal and state securities laws" when in fact "MFS securities did not qualify as exempt private placements" and were sold in violation of the federal and state securities laws. The Roots believed these individuals knew there were security law violations but rather than tell the Roots about their right to rescind the transactions, they concealed the illegal nature of the transactions.

The complaint alleged these specific individuals also misrepresented or failed to disclose the following material facts: (1) the risks with investing in MFS; (2) their commissions from the stock sales; (3) they claimed to be taking minimal salary compensation when in fact they were receiving excessive compensation and paying personal expenses from the stock subscription money; and (4) Porche was the subject of SEC civil and administrative proceedings resulting in permanent injunctions such as barring him from associating with any brokers, dealers, or investment advisors. Beck recalled that during a meeting with O'Connor and Cooper they revealed MFS's board directed a $340,000 commission payment using the Roots' investment funds.

Beck maintained the Pinkerton Action has several problems from the start. First, Jolly Roger, not the Roots, purchased MFS stocks. More importantly, Roger Root knew CTI was not MFS's subsidiary because he was invited (on Jolly Roger's behalf) to participate in CTI's stock offering but he had declined. Second, Beck submitted evidence showing Jolly Roger was a "defunct" corporation when the lawsuit was filed. The documents revealed Jolly Roger filed articles of dissolution in early 2015 and was not reinstated until January 17, 2019.

Another issue was the inherent inconsistency in the requested remedies. On one hand, the Roots were willing to settle their direct action for 10,000,000 CTI Founders shares and a seat on the CTI board. On the other hand, the Roots derivative claims sought cancellation of all CTI stock certificates because MFS allegedly owned 100 percent of CTI.

What is detailed in the appeal presented a problem for Catanzarite. Not only was MFS a defunct company- worth nothing- rather than the proper owner of CTI- as Catanzarite claimed- but his client invested in MFS, using a company which had itself become defunct.

Beck maintained the Pinkerton Action has several problems from the start. First, Jolly Roger, not the Roots, purchased MFS stocks. More importantly, Roger Root knew CTI was not MFS's subsidiary because he was invited (on Jolly Roger's behalf) to participate in CTI's stock offering but he had declined. Second, Beck submitted evidence showing Jolly Roger was a "defunct" corporation when the lawsuit was filed. The documents revealed Jolly Roger filed articles of dissolution in early 2015 and was not reinstated until January 17, 2019.

Somewhere around this point, Catanzarite recruited most of the same people he had once accused of fraud- O’Conner, Cooper, and others- and using the threat of pending criminal charges, they provided him with bogus documents.

This same faction- which had once been sued by Catanzarite- teamed up with Catanzarite to sue Beck and others.

The gravamen of Beck's complaint is the theory that sometime between November 2018 and January 2019, Catanzarite and the O'Connor Faction struck a deal. Specifically, they set into motion a scheme to save members of the O'Connor Faction from liability in the Pinkerton Action. Beck provided evidence showing that around January 2019 many Pinkerton Action defendants entered into settlement agreements with Catanzarite. They agreed to "renounce" their CTI shares in favor of MFS and entered "into separate agreements to allege-now, for the first time-that CTI had been a subsidiary of MFS all along ...." On December 13, 2018, Catanzarite dismissed Porche, and in early January it dismissed Mobin, two of the primary wrongdoers named in the Pinkerton Action.

While Catanzarite was negotiating agreements with other defendants, it continued litigating the Pinkerton Action. Beck asserted the parties eventually designed a scheme that involved misusing the judicial process, publicizing unlawful CTI shareholder written consents, and sending e-mails intent on destabilizing CTI's operations by interfering in merger negotiations and other business prospects. If this plan worked, MFS (controlled by the O'Connor Faction) would be able to regain control of CTI's business/profits and reallocate all the stock shares. MFS shareholders (including the Roots) would likely also benefit from the shift in power.

January 2019 was a busy month for Catanzarite, setting in motion the group's corporate takeover scheme. On January 4, 2019, it dismissed Scudder and Aroha from the Pinkerton Action. On January 22, 2019, it dismissed O'Connor, TGAP, and Unfug. The following day, Catanzarite dismissed Cooper and Higgerson. Thereafter, O'Connor and Cooper used their MFS shareholder votes to reconstitute the MFS board of directors. MFS hired Catanzarite as corporate counsel.

On January 23, 2019, O'Connor executed a "unanimous written consent of the sole shareholder of [CTI]" (2019 Consent), stating he was CEO of MFS and had authority to act by unanimous written consent without a meeting to adopt several resolutions. The first resolution stated MFS was the sole shareholder of CTI and O'Connor, in his capacity as CEO, could issue the written consent stating MFS fully paid for 28,000,000 shares of CTI common stock in March 2015. The next resolution stated the Amended Acts contained the false contention MFS "had not fully paid for all of its stock [was] facilitated by the wrongful and self-serving conduct" of Probst and Beck. Accordingly, all actions, issuance of shares, and promisors were void or voidable acts. In essence, the written consent sought to unwind three years of CTI's corporate acts.

Catanzarite would ventually make himself an employee of MFS, CTI, and other actions which created blatant conflicts.

Thus, to briefly recap, at this point Catanzarite's concurrent and successive representation of adverse parties included the following: (1) Catanzarite was representing the Roots' elder abuse lawsuit against CTI and some of its Founders (the Probst Faction) as well as a derivative action against MFS; (2) Catanzarite had made a deal with a handful of CTI Founders to dismiss them from the Pinkerton Action; (3) it became MFS's counsel of record; (4) Catanzarite filed a derivative shareholder lawsuit for MFS, claiming 100 percent control and ownership of CTI, despite having lawsuits filed by other people claiming to be MFS shareholders; and (5) after filing two derivative shareholder lawsuits, Catanzarite filed a third derivative action (the Mesa Action) claiming to represent a different set of outsider shareholders, i.e., a class of derivative shareholders willing to join in the MFS Action but also independently seeking damages from CTI, its current shareholders, and board of directors.

At the end of May 2019, Catanzarite filed a lawsuit on behalf of Cooper and Mebane against CTI. The Cooper Action requested the court direct CTI to (1) hold a shareholder's meeting to elect a board of directors; (2) deliver an annual report; (3) appoint an accountant to conduct an audit; and (4) order CTI to pay the costs for an investigation, audit, and costs of the suit. CTI's corporate counsel filed an opposition, asserting a shareholder meeting was scheduled for August 2019.

Catanzarite and his allies also interfered with CTI’s business in other ways.

In addition, the 2019 Consent "resolved" that the entire CTI board of directors was wrongly elected "by shareholders other than MFS" and they were immediately removed. MFS rescinded all CTI's stocks and promissory notes. It elected O'Connor, Zakhireh, and Murphy to serve as CTI's directors. It terminated CTI's auditor and legal counsel.

Around this same time, Catanzarite sent CTI's largest secured creditor, FinCanna, an e-mail stating future modifications or agreements between them must be signed by the new CTI board members (O'Connor, Zakhireh, and Duffy). (See Cultivation, supra, G059457 [detailed discussion of Catanzarite's damaging e-mails to CTI's business partners]). Catanzarite also took steps to interfere with CTI's proposed merger with Western Troy Capital Resources, Inc, by writing an e-mail to the company stating the new CTI directors objected to the merger.

All of these actions led to Beck leaving CTI, and this once thriving business disintegrated.

It’s not the only time Catanzarite has used questionable ethics in business lawsuits.

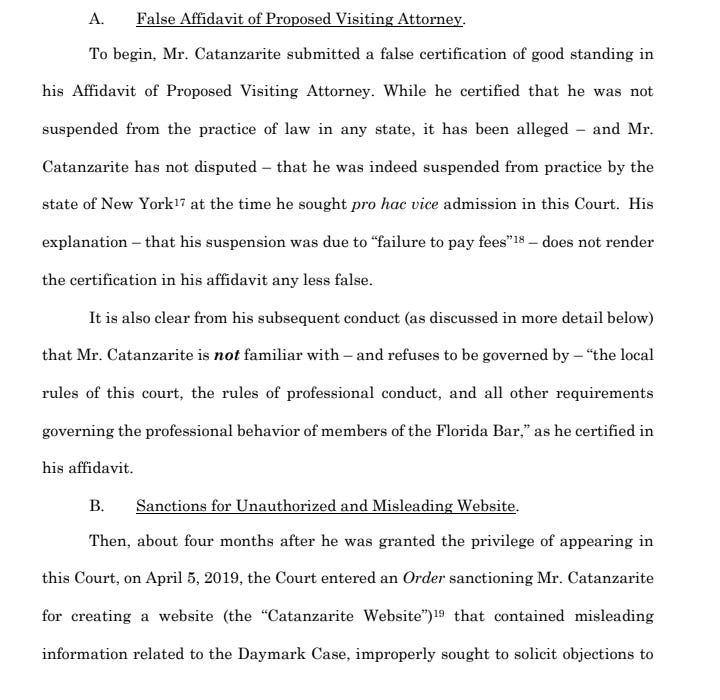

In a series of lawsuits filed against a real estate trust going through bankruptcy, a judge called Catanzarite’s actions “vexatious.”

He was accused of fraud and deception.

Justin filed a lawsuit for malicious prosecution.

Catanzarite defended himself in a novel way: using the anti-SLAPP statute.

SLAPP stands for Strategic Lawsuit Against Public Participation.

Anti-SLAPP laws are supposed to protect journalists and others who speak out on issues of public importance. Here is more from the Reporters Committee for Freedom of the Press.

Anti-SLAPP laws provide defendants a way to quickly dismiss meritless lawsuits—known as “SLAPPs” or “Strategic Lawsuits Against Public Participation”—filed against them for exercising speech, press, assembly, petition, or association rights. These laws aim to discourage the filing of SLAPP suits and prevent them from imposing significant litigation costs and chilling protected speech.

As Justin explained, in California, Catanzarite is part of a crew of unscrupulous attorneys who have used anti-SLAPP for their own devices.

Claiming that the act of filing a lawsuit amounts to “petitioning the government”, these attorneys use anti-SLAPP as a response if they are counter sued, as Justin did.

Here is more from the appeal.

Resolution of an anti-SLAPP motion involves two steps. First, the defendant must establish that the challenged claim arises from activity protected by section 425.16, and if the defendant makes this showing, the burden shifts to the plaintiff to demonstrate the merit of the claim by establishing a probability of success. [Citation.] On appeal, we review the trial court's ruling on the anti-SLAPP motion de novo. [Citation.]" (Wittenberg v. Bornstein (2020) 50 Cal.App.5th 303, 311-312 (Wittenberg).) "To establish a probability of prevailing, the plaintiff 'must demonstrate that the complaint is both legally sufficient and supported by a sufficient prima facie showing of facts to sustain a favorable judgment if the evidence submitted by the plaintiff is credited.' [Citations.] For purposes of this inquiry, 'the trial court considers the pleadings and evidentiary submissions of both the plaintiff and the defendant (§ 425.16, subd. (b)(2)); though the court does not weigh the credibility or comparative probative strength of competing evidence, it should grant the motion if, as a matter of law, the defendant's evidence supporting the motion defeats the plaintiff's attempt to establish evidentiary support for the claim.' [Citation.] In making this assessment it is 'the court's responsibility . . . to accept as true the evidence favorable to the plaintiff ....' [Citation.]

The plaintiff need only establish that his or her claim has 'minimal merit' [citation] to avoid being stricken as a SLAPP. [Citations.]" (Soukup v. Law Offices of Herbert Hafif (2006) 39 Cal.4th 260, 291-292 (Soukup).) We will address each cause of action separately.

In the end, the appeals court did strike down most of the anti-SLAPP claims, but for other ancillary reasons: as Justin explained.

This court, and others, have now created case law in California which protects lawyers who file lawsuits with anti-SLAPP protection. The mere act of filing a lawsuit in California is considered an act of petitioning the government and protected under anti-SLAPP.

Finally, many of Catanzarite’s acts appear to violate legal ethics. This seems like a job for the California BAR.

I asked Justin if Catanzarite has any BAR complaints.

“He’s absolutely been reported to the bar. In fact, that’s when I started to understand the way this Girardi scandal that you’re hearing about in the news right now. It’s not limited to Mr. Girardi.” Justin explained.

Girardi is Tom Girardi, who was recently indicted for embezzling millions from clients.

A grand jury has indicted Tom Girardi for allegedly embezzling more than $15 million from his clients, the Department of Justice announced Wednesday.

The disgraced attorney, 83, was charged with five counts of wire fraud, according to a copy of the indictment obtained by Page Six.

Girardi and Christopher Kazuo Kamon, the former controller and chief financial officer of the law firm Girardi Keese, are accused of lying to their clients in order to misappropriate settlement funds.

The attorney and his former CFO allegedly used the clients’ winnings to fund payroll, other clients’ settlement funds that had previously been misappropriated and personal expenses.

More recently, it was revealed that Girardi bribed a California BAR investigator $1 million to look the other way on years of malfeasance.

Disbarred Los Angeles lawyer Tom Girardi funneled more than $1 million in gifts and payments to an investigator at the State Bar of California and the investigator’s wife, a USC accounting professor, according to a report released Friday.

The long-anticipated report, the result of a year-and-a-half investigation by a law firm working for the State Bar’s governing board, detailed how Girardi cultivated and sustained an “extensive network of connections at all levels” of the agency tasked with regulating California’s legal profession and described corruption beyond what is publicly known.

The investigator, Tom Layton, and his wife, Rose, received more than $600,000 in payments from Girardi, and Layton enjoyed the use of a credit card paid for by Girardi’s law firm, among other perks, according to the report.

Justin believes that Catanzarite, Girardi, and others are a part of an “elite” set of lawyers who are protected by the BAR.

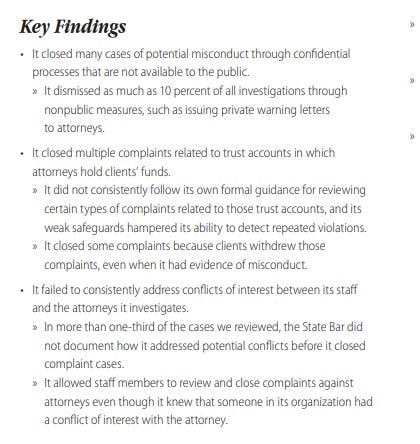

“The State BAR of California seems to operate for a select group of elite attorneys.” Justin said, “there are statistical anomalies that the auditor identified.”

This auditor is the California State Auditor which found numerous problems with the BAR discipline process in 2022.

I reached out to the California BAR but received no response.

Post-script

Check out the previous articles on the series on Orange County. Part 1, Part 2, Part 3, Part 4, Part 5, Part 6, Part 7, Part 8. Part 9, Part 10, Part 11, Part 12, Part 13, Part 14, Part 15, Part 16, Part 17, Part 18, Part 19, Part 20, Part 21, Part 22, Part 23, Part 24, Part 25. Part 26, Part 27, Part 28, Part 29, Part 30, Part 31, and Part 32.

To support more stories like this please consider contributing to the Orange County fundraiser.

Michael Volpe Investigates Podcast the Impromptu: Episode 62 an Interview with Justin Beck